Stay Ahead of Default Risks:

Leveraging AI with RisQ for Credit Monitoring

The overall annual default rate for Indian companies reached a decadal low of 0.6% in 2023. Prima facie, this seems a welcome shift. But lending is far more complicated than that, isn't it?

Although the default rate was reduced, the number of companies that failed in debt repayments totaled 153 in 2023, up from 85 the previous year, representing an 80% increase. The total increase in borrowers, combined with a few other factors, resulted in such an alarming number.

A single wrong decision is enough to blow lending enterprises out of the game. This is the reason why credit monitoring essentially needs to be foolproof from all frontiers and raises the question, are conventional methods sufficient for safer transactions?

What's Conventional About Credit Monitoring?

The landscape of credit monitoring is rife with challenges. Traditional methods often need to provide timely insights into evolving risk patterns. With global economic dynamics constantly shifting, predictive analytics is paramount to preempting potential defaults.

Conventional models, reliant on historical data and static risk assessments, need help keeping pace with today's markets' dynamic nature. Moreover, manual intervention introduces delays and inaccuracies, leaving businesses vulnerable to unforeseen risks. In this scenario, robust tools for proactive risk management are necessary for sustainable growth.

What's The Solution To Enhance Credit Monitoring

Enter Corpository’s RisQ, our innovative solution tailored to address the intricacies of modern credit monitoring. Powered by advanced AI and ML algorithms, RisQ revolutionizes how businesses mitigate default risks. Our platform harnesses the power of predictive analytics to forecast potential defaults well in advance, empowering organizations to take proactive measures.

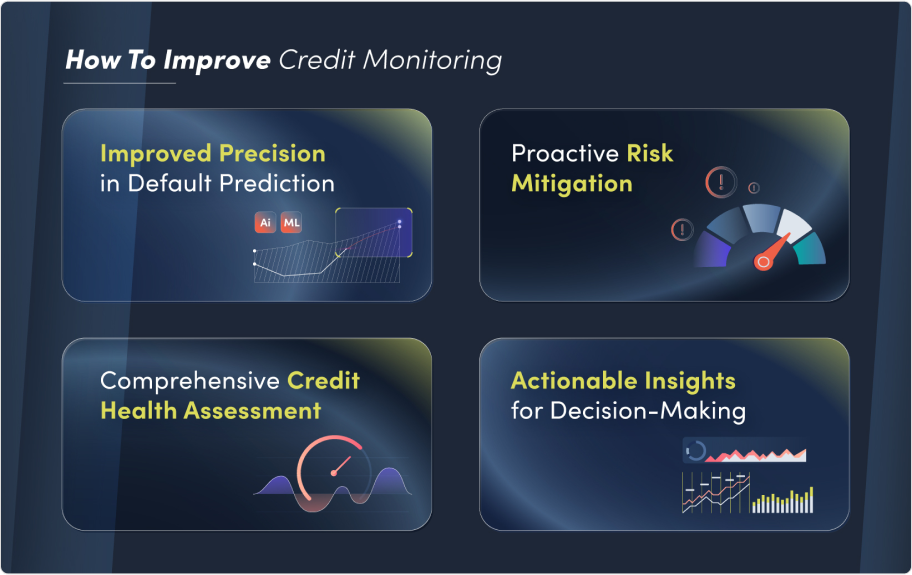

- Precision in Default Prediction : RisQ utilizes advanced AI and ML algorithms to predict defaults with precision.

- Proactive Risk Mitigation : Predictive analytics enable proactive risk mitigation measures.

- Comprehensive Credit Health Assessment : Dynamic portfolio risk matrix provides a comprehensive credit health assessment.

- Actionable Insights for Decision-making : Detailed company reports offer actionable insights for informed decision-making.

How Does It Help Lenders?

- Enhanced Default Anticipation :The ability to anticipate defaults with 85% accuracy empowers organizations to implement timely corrective measures, thereby safeguarding financial stability.

- Efficient Risk Assessment Automation : The automation of risk assessment processes reduces manual effort and minimizes the margin for error. By leveraging 300+ data points and behavioral pattern analysis, RisQ unveils hidden risk signals, enabling businesses to stay ahead of the curve.

- Prompt Action with Auto Alerts : Providing auto alerts ensures prompt action in response to emerging risks, fostering a proactive risk management culture.

- Uncovering Hidden Risk Signals : Behavioral pattern analysis uncovers hidden signals for proactive risk mitigation.

The Bottomline

In the landscape of credit monitoring, there is a discernible shift in the winds, necessitating a proactive approach to adapt to evolving challenges. Embracing cutting-edge technology, particularly Artificial Intelligence (AI) and Machine Learning (ML), emerges as the cornerstone for navigating the complexities of risk management.

Positioned at the forefront, RisQ offers a comprehensive solution, empowering businesses with predictive insights and proactive strategies. Embrace the forefront of credit monitoring with RisQ, where preparedness and resilience meet every wave of risk with confidence.

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.