How Do Accurate GST Analyzers Help In

Credit Underwriting?

Did you know that the GST intelligence and CGST authorities have booked more than 3,200 cases against 9,600 fake GSTIN entities as of 2023? Although 329 fraudsters have been arrested, most such cases do go unnoticed.

Despite the vice impact this will have on the nation’s economy, it poses a greater threat to the credit ecosystem. Lenders will find it more difficult to manually identify such discrepancies in company practices. Keeping the fraudulent aspect aside, the right GST analysis adds to concluding a more accurate credit assessment in great depth.

That’s why we need GST analyzers that act as a sort of GPS guide for a chunk of any credit evaluation. Much like navigating through bustling city streets, accurate GST analyzers are one of the compasses leading businesses to reliable credit underwriting decisions.

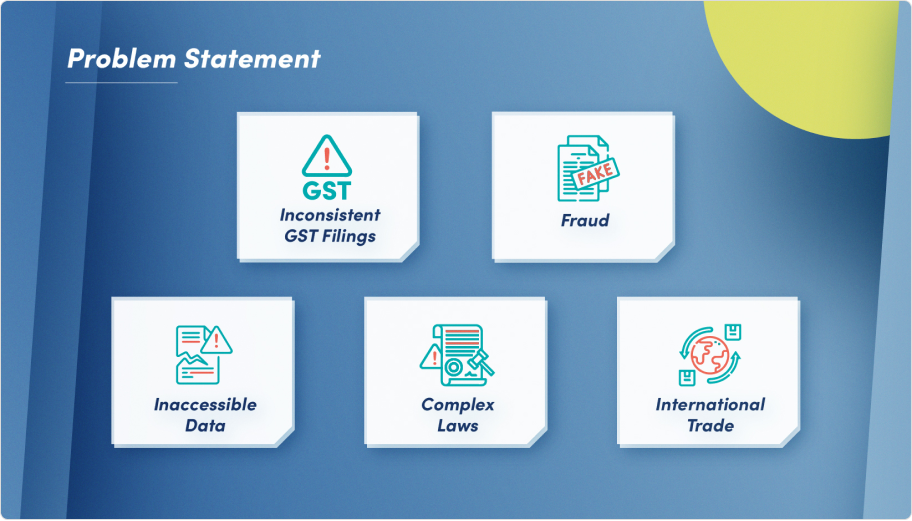

- Inconsistent GST Filings : Mismatched or delayed filings make it hard to verify financial accuracy.

- Fraudulent Practices : Fake invoices or claims misrepresent a borrower's finances.

- Cash Flow Disruptions : GST changes impact cash flow, affecting debt servicing.

- Data Accessibility Gaps : Missing or inaccessible GST data hampers analysis.

- Interpreting Complex GST Laws :Understanding regulations poses challenges.

- GST Law Amendments : Frequent changes create uncertainties for businesses.

- Cross-Border Transaction Complexities : International trade adds GST compliance complexities, impacting credit assessments.

Solution Offered

- Consistency Checks : Identifying and flagging discrepancies or delays in filings for improved accuracy.

- ITC Reconciliation : Streamlining the process of reconciling input tax credits across transactions.

- Fraud Detection : Using algorithms to detect and flag potential fraudulent practices like fake invoices.

- Industry-Specific Analysis : Tailoring evaluations to accommodate industry-specific GST nuances.

- Cash Flow Projections : Forecasting cash flow disruptions due to GST changes for better debt servicing assessment.

- Data Aggregation Tools : Streamlining data aggregation from diverse sources for comprehensive analysis.

- AI-Driven Regulatory Interpretation : AI-powered systems interpreting complex GST laws for better contextual understanding.

- Real-Time Updates : Providing prompt updates on GST law changes for timely adaptations.

- Cross-Border Transaction Support :Handling complexities in international transactions for accurate GST compliance assessment.

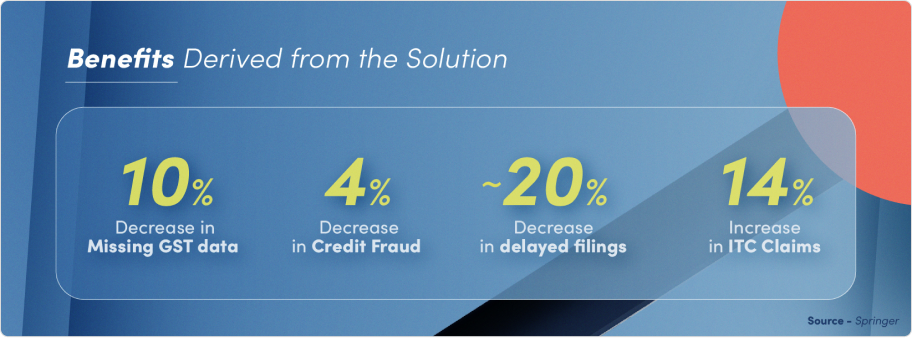

- Enhanced Accuracy :Automated consistency checks and reconciliation processes ensure more accurate financial data, reducing errors in credit assessments.

- Efficiency Improvement : Streamlining data aggregation and reconciliation tasks saves time, enabling quicker and more efficient credit evaluations.

- Fraud Prevention : Advanced fraud detection algorithms help identify potential fraudulent activities, safeguarding lenders from risky borrowers.

- Customized Assessments : Industry-specific analysis allows for tailored evaluations, accommodating unique GST nuances for more precise credit decisions.

- Improved Risk Assessment : Cash flow projections and real-time updates on GST changes aid in assessing a borrower's ability to manage debt, reducing lending risks.

- Comprehensive Analysis : Data aggregation tools bridge accessibility gaps, ensuring a more comprehensive evaluation of a borrower's financial health.

- Regulatory Compliance : AI-driven interpretation of complex GST laws ensures better compliance understanding, mitigating risks associated with non-compliance.

- Adaptability : Real-time updates on GST amendments enable lenders to adapt quickly to regulatory changes, ensuring up-to-date evaluations.

Conclusion:

With a dawning Experience Age, customers actively seek the easiest access and seamless experience. Automation brings this to credit evaluation in titanic proportions. Considering the relevance GST analysis plays in this, it’s only sensible to automate this as well.

That’s why effective GST Analyzers can fast-track and fortify the entire evaluation process. Embracing these tools not only ensures precision in assessment but also safeguards businesses against the pitfalls of inaccurate financial data. The trick is to find the right service provider for this.

As the financial landscape evolves, harnessing the power of precise GST analyzers becomes indispensable for secure and confident credit underwriting decisions. At Corpository, keep this in mind and ensure the best-suited features in our credit assessment ranging from fundamental ST analyzers to sophisticated risk predictors.

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.