Augmenting India’s MSME Upswing:

7 Ways AI Elevates Credit Monitoring

"The unknowns of space pose dangers, but they also present the opportunity to explore the uncharted territories and expand the limits of what is possible."

- Buzz Aldrin

The MSME sector is the territory that can expand the limits of the lending space in India.

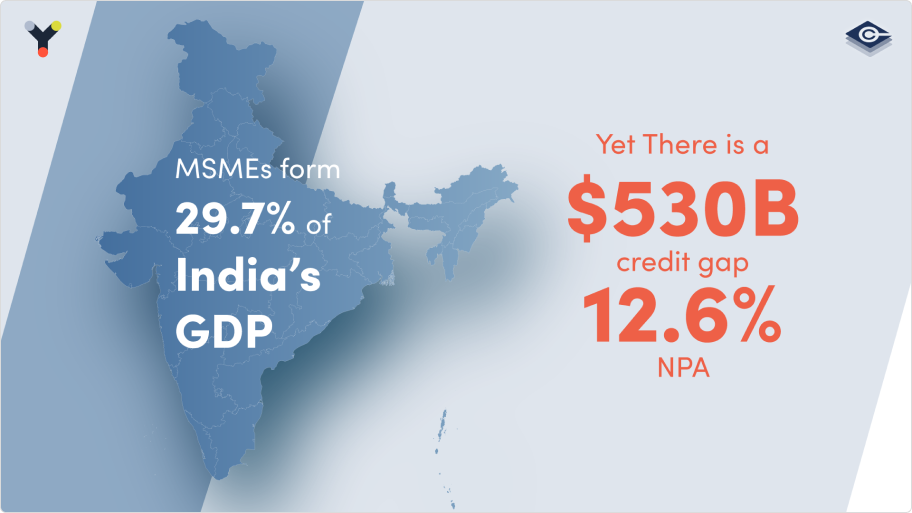

For long lenders have seen MSMEs as low hanging fruits as opposed to the whale fall it can become. Did you know according to the MoSPI the MSME sector contributed about 29% of the country’s GDP in 2022, up from 17.4% in 2013? With a projected GDP growth rate of over 6.5% in FY24, evidently, it's an indomitable force driving the nation towards the ambitious $5 trillion goal. However, lenders supporting the sector face a looming challenge: identifying the legitimate from the fake.

Lenders encounter a plethora of financial asteroids during credit evaluation, ranging from company overview data to advanced risk factors. Instead of trying to tackle them as issues, we can observe the hidden opportunities they present to explore. It's all about how you perceive them and identify the right latent cluster.

For this, effective navigation tools are necessary. Let’s examine if and how AI can excel in credit monitoring.

The Enigmata of MSME Credit Monitoring

- Data Dearth : A mere 14% of over 64 million Indian MSMEs boast accessible credit, unveiling an alarming credit gap of $530 billion within an $819 billion demand.

- Varied Landscapes : SMEs weave through volatile cash flows, and diverse models, contributing 29.7% of the GDP, yet grappling with tech dearth and limited market access.

- Interconnected Dynamics : Complex SME relationships with stakeholders echo soaring credit growth rates but yield a concerning 12.6% non-performing asset ratio.

- Data Diversity : Supplementing traditional data with GST, mobile records, and digital footprints unveils holistic SME insights.

- AI-Driven Insights : Harnessing machine learning offers dynamic credit scores, risk predictions, and proactive alerts, refining risk management.

- Fintech Synergy : Collaborating with fintech innovators opens avenues for digital lending, supply chain finance, and customer-centric products.

Why To Take The Initiative?

- Risk Mitigation : Lower default rates and bolstered profitability within SME lending portfolios

- Access and Affordability : Heightened accessibility to credit for burgeoning SMEs.

- Economic Empowerment : Fostering growth, innovation, and resilience within the SME sector.

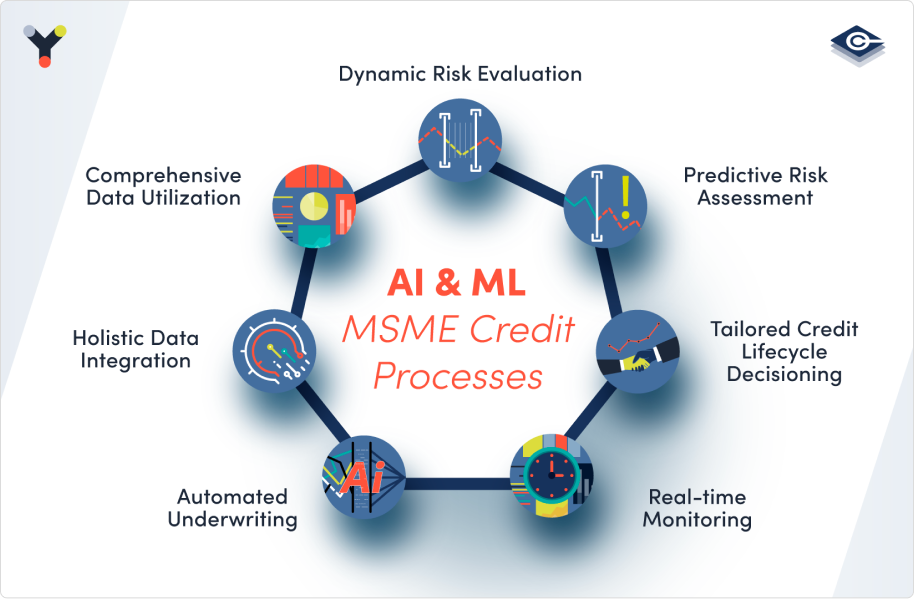

How AI And ML Technology Can Help Augment MSME Credit Processes

- Holistic Data Integration : Employ AI to amalgamate diverse data sources like financial statements, transaction histories, and industry benchmarks. This comprehensive approach enhances credit assessment accuracy.

- Real-time Credit Monitoring : Develop ML algorithms for continuous monitoring of financial behaviors, providing real-time insights into changes in creditworthiness for B2B clients.

- Predictive Risk Assessment : Utilize AI-driven predictive analytics to identify default patterns, foresee potential risks, and proactively mitigate defaults.

- Dynamic Risk Evaluation : Implement ML algorithms to dynamically evaluate risk factors across the credit lifecycle, assisting in nuanced decision-making.

- Automated Underwriting Processes : Integrate AI-driven automation in underwriting, streamlining tasks and enabling a focus on complex evaluations and tailored solutions.

- Tailored Credit Lifecycle Decisioning : Develop adaptive ML models to tailor decision-making processes based on evolving data points and client needs.

- Comprehensive Data Utilization : Leverage AI to integrate GST records, mobile usage, digital footprints, and other diverse data for more informed credit evaluations and risk assessments.

The fusion of AI and ML models revolutionizes SME credit assessment, paving the way for an inclusive, efficient, and insightful credit ecosystem. These innovations act as a beacon, illuminating a path through the challenges that have long obscured the SME credit cosmos.

Embracing the Odyssey

In essence, the MSME credit landscape is a cosmic canvas awaiting exploration. By harnessing alternative data with AI, and fostering fintech alliances, lenders like banks and NBFCs can chart a course to decipher the SME credit universe, paving the way for growth with minimal risk.

The major aspect when you adapt to this revolution is how you do it. Make sure you have an effective fintech provider to enhance your credit processes. At Corpository, we focus on delivering the best resources and solutions to our clientele with detailed data and analysis without bombarding them with jargon. A tightrope on which we walk seamlessly. Learn more about how we can help you achieve your goals faster.

Visit www.corpository.com.

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.