4 Ways To Evolve Credit Underwriting:

How AI and ML Revolutionize Risk Analysis

"The unknowns of space pose dangers, but they also present the opportunity to explore the uncharted territories and expand the limits of what is possible."

– Ginni Rometty, Former CEO of IBM

Did you know that the OECD estimated that credit underwriting with the adoption of AI and ML technologies in January 2022 is approximately 50% to 80% faster compared to the manual processes in January 2012? Augmenting human intelligence with artificial intelligence rendered this evolution from dinosaur methods of credit evaluation.

But how exactly does it help credit underwriting and decisioning? Are traditional methods really archaic, as the progressivists make them out to be? Is it a short-term boon with a long-term complication? Let’s have a look at how credit underwriting was and how it can be with a closer insight into ‘Why AI and ML is essential for its future.’

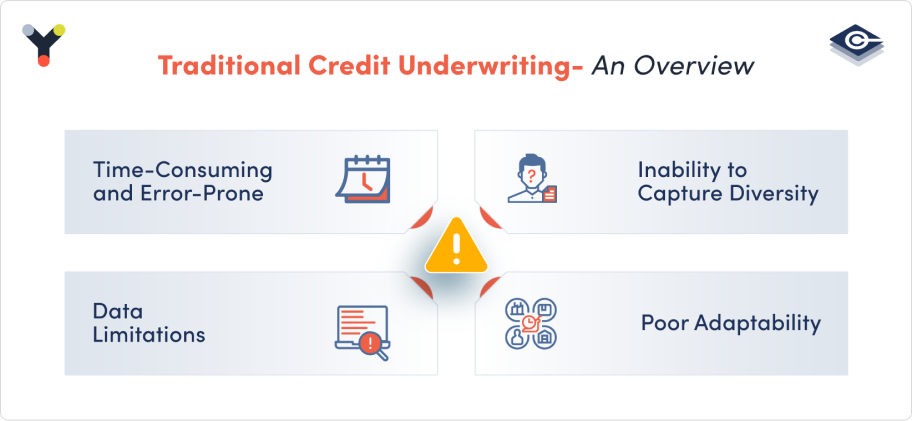

- Time-Consuming and Error-Prone : Manual underwriting is slow, taking weeks and leading to loan approval delays.

- Inability to Capture Diversity : Traditional methods rely on historical credit data and may overlook up to 35% of consumer information, limiting understanding of customer profiles.

- Inability to Capture Diversity : Traditional methods rely on historical credit data and may overlook up to 35% of consumer information, limiting understanding of customer profiles.

- Inflexibility : Traditional approaches are rigid and slow to adapt to changing market conditions or customer behaviors, taking months to adjust lending strategies.

The pandemic underscored these issues, prompting lenders to pivot toward agile, data-rich, and efficient underwriting processes. In a fast-changing financial landscape, the demand for advanced solutions intensifies daily.

The AI and ML Solution- How To Enhance Credit Underwriting

- Automation and Efficiency : AI and ML automate and streamline credit underwriting, reducing human intervention and increasing efficiency and accuracy.

- Expanded Data Sources : They enable the analysis of a wider range of data sources, including alternative data such as social media, e-commerce, mobile phone usage, and psychometric tests, offering deeper insights into customer profiles and preferences.

- Advanced Analytics : AI and ML employ advanced analytical techniques like deep learning, random forests, gradient boosting, etc., to build powerful and flexible models that can capture complex patterns and relationships in the data.

- Dynamic Adaptation : These technologies allow dynamic monitoring and updating of models in real-time, reflecting changing customer behaviors and market conditions.

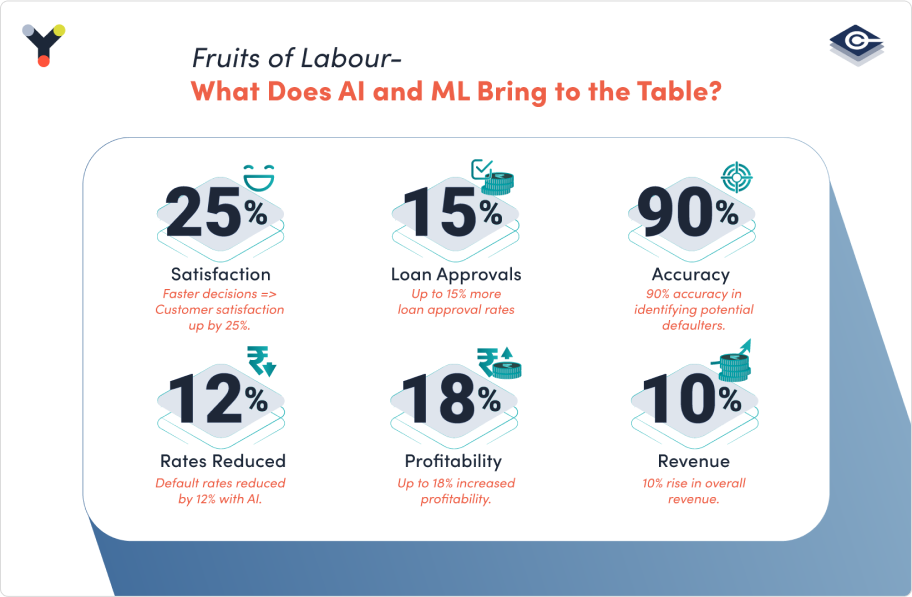

- Enhanced Customer Experience :AI-driven systems reduce decision time from days to hours, increasing customer satisfaction by 25%.

- Expanded Loan Approval Rates : AI and ML enhance approval rates by up to 15%, attracting new-to-credit customers and leading to a 20% increase in applications from underserved segments.

- Reduced Credit Risk : AI identifies potential defaulters with 90% accuracy, enabling preventive actions that reduce default rates by 12%.

- Optimized Profitability : AI-driven underwriting optimizes pricing and terms, resulting in an 18% increase in profitability and a 10% rise in overall revenue through tailored offerings.

One of McKinsey's reports highlights a 3% boost in bank capital returns over three years through AI-driven credit underwriting. Meanwhile Deloitte's findings show 40% of financial firms apply AI in risk management, underscoring industry recognition of these transformative technologies.

Conclusion:

AI and ML technologies are revolutionizing credit underwriting, enabling lenders to make smarter and more informed decisions that benefit both their customers and their businesses. When we fail to adapt to such financial terraforming, then promising enterprises merely become fossilized versions of themselves.

The future of credit underwriting is tech-driven, and the question is: Are you ready for it? We, at Corpository, focus on leveraging metamorphosing technology like AI for enhanced credit life-cycle decisioning. Embracing these technologies is not just a step forward; it's a leap into a more efficient, accurate, and customer-centric era of lending.

Check out on how Corpository is evolving in the lending landscape!

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.