How Lenders Can leverage GST Data Of 14 Million

Entities With GST Analyzers

Did you know that as of January 2023, the number of entities liable to pay GST in India under the “normal taxpayer” category consisted of more than 12.2 million taxpayers? The overall figures were over 14 million registered GST taxpayers during this time. Essentially, there are a lot of entities and individuals whose GST filing data can be used for credit underwriting.

Ever since, the relevance of GST analysis has superseded many other parameters considered during credit evaluation. Now, this has transformed into a digitized sphere with tools like GST analyzers. Let’s have a look into the evolution of these tools and how they are revolutionizing credit evaluation in India.

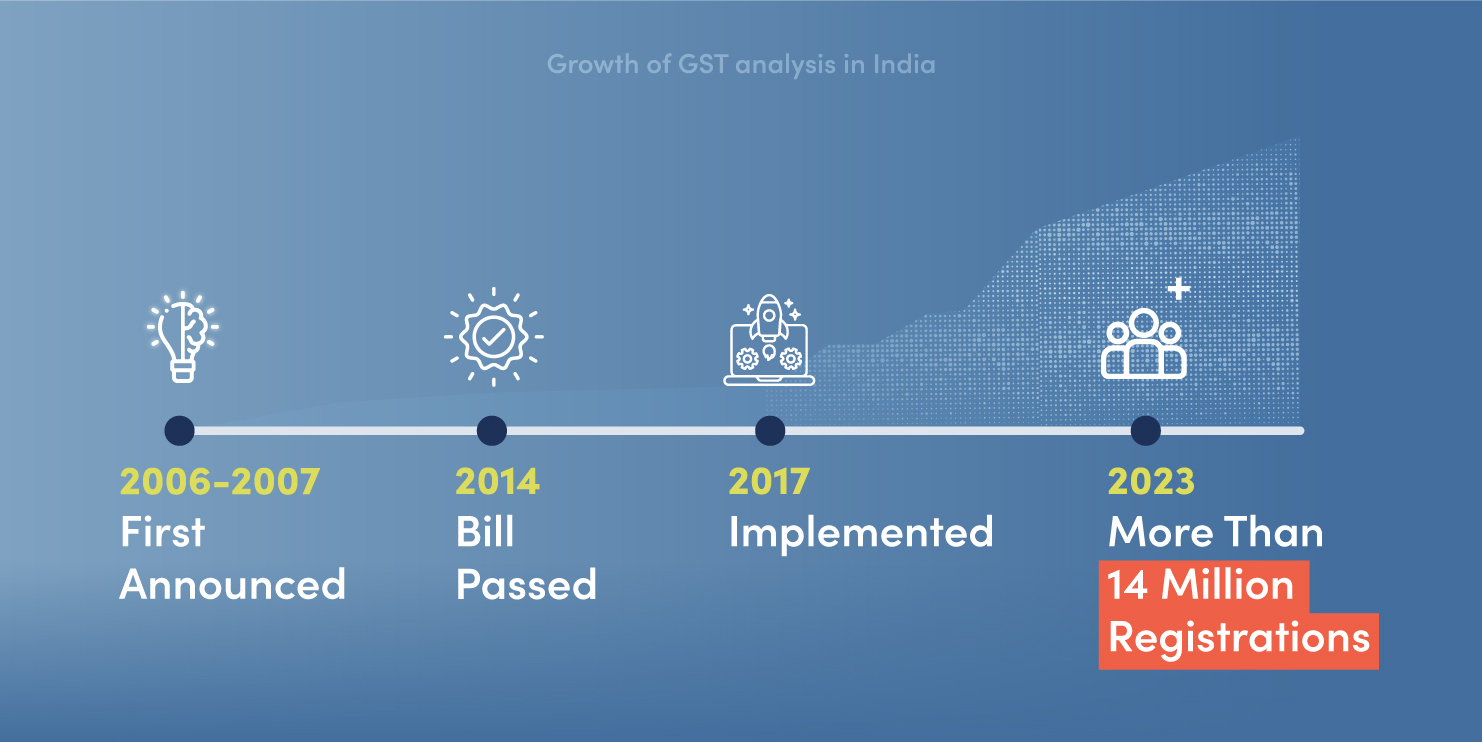

The Growth Of GST Analysis In India

The GST was first announced in the Union Budget of 2006-07. It culminated in passing the Constitution (122nd Amendment) Bill in December 2014, followed by state legislatures. GST was officially rolled out on July 1, 2017. It has marked a significant turning point in India’s economic landscape by consolidating various indirect taxes into a single unified tax. GST streamlines compliance processes, bolsters tax revenues, and fosters transparency within the business ecosystem. However, beyond its primary objectives, GST inadvertently catalyzes a progressive equilibrium in credit evaluation for lenders by unlocking a vast reservoir of digital data.

This data deluge prompts the emergence of sophisticated analytics tools such as GST analyzers, which enable financial institutions to harness insights from GST filings to inform credit underwriting and risk management decisions. Since their inception, GST analyzers have evolved remarkably, transitioning from basic data aggregation tools to integrated aspects of cutting-edge platforms for credit evaluation. Looking ahead, the trajectory of GST Analysis in India points toward a future where data-driven decision-making becomes the norm in the lending landscape.

Understanding GST Analysers

GST analyzers are sophisticated tools that harness the power of technology and data analytics to delve deep into a business’s GST filings and financial transactions. These tools aggregate, organize, and analyze GST data to give lenders comprehensive insights into borrowers’ financial activities. By scrutinizing GST returns, invoices, turnover, tax payments, and compliance records, these analyzers offer a comprehensive view of a business’s performance and viability.

Streamlining Credit Underwriting

Traditionally, lenders relied on financial statements, balance sheets, and tax returns to evaluate a borrower’s creditworthiness. However, these documents often provided a limited snapshot of a business’s financial health. GST analyzers, on the other hand, offer real-time and granular insights that enable lenders to make more informed decisions.

- Accurate Revenue Assessment: GST data provides a detailed breakdown of a business’s sales and revenue streams. Analyzing this data helps lenders verify the accuracy of revenue figures claimed by borrowers, mitigating the risk of fraudulent representations.

- Cash Flow Analysis: Cash flow is a critical indicator of a business’s financial stability. By analyzing GST data, lenders can track the inflow and outflow of funds, identify patterns of cash flow management, and assess the borrower’s ability to meet debt obligations.

- Operational Efficiency: GST analyzers offer insights into a business’s operational efficiency by analyzing factors such as inventory turnover, supplier relationships, and compliance with GST regulations. Lenders can gauge the efficiency of a borrower’s operations and assess their capacity to generate sustainable cash flows.

Enhancing Risk Management With GST Analysers

In addition to facilitating credit underwriting, GST analyzers play a crucial role in risk management for lenders.

- Early Warning System: By monitoring GST filings and compliance records, analyzers can flag potential red flags, such as irregularities in tax payments or deviations from industry norms. Early detection of such anomalies enables lenders to take proactive measures to mitigate risks associated with lending.

- Sector-Specific Insights: Different industries have unique GST profiles influenced by factors such as seasonality, demand fluctuations, and regulatory changes. GST analyzers equipped with sector-specific analytics enable lenders to tailor their risk assessment models according to the nuances of each industry, minimizing sector-related risks.

The Future of GST Analysers

As we look ahead, the future of GST analysis appears promising, with several key trends and developments poised to reshape the landscape of credit evaluation and lending in India.

- Emerging Tech Integration: Integrating emerging technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics will play a pivotal role in revolutionizing GST analysis. Advanced algorithms empowered by AI and ML will enable more profound insights into GST data, uncovering hidden patterns and trends that were previously inaccessible. Additionally, leveraging blockchain technology could enhance data security and transparency, further bolstering the credibility of GST data for lenders.

- Expanded Data Sources: While GST data has already proven valuable, the future entails integrating additional data sources beyond traditional tax filings. This expansion could include incorporating data from banking transactions, supply chain records, and e-commerce platforms. By harnessing data from diverse sources, GST analyzers can offer a more comprehensive view of a borrower’s financial health, leading to richer insights and enhanced accuracy in credit assessments.

- Customization: Advancements in analytics capabilities will enable GST analyzers to become more customizable and personalized than it already is to meet the specific needs of lenders. Tailored algorithms and predictive models can be designed to cater to different lending scenarios, whether it’s assessing the creditworthiness of a small business or a large corporation. This customization ensures lenders receive precise and relevant insights, ultimately enabling better-informed decision-making.

- Regulatory Compliance: As regulatory requirements evolve, GST analyzers will play a crucial role in ensuring compliance. Lenders can stay abreast of changing regulations and mitigate compliance risks by integrating regulatory updates and compliance checks into analyzer platforms. Standardization of data formats and reporting protocols will further streamline the exchange of information between lenders and borrowers, enhancing efficiency and transparency in the lending process.

- Collaboration: Collaboration among financial institutions, technology providers, and regulatory bodies will drive innovation and adoption of GST analyzers. By fostering partnerships and sharing best practices, stakeholders can collectively advance the capabilities of GST analysis and accelerate its integration into mainstream lending practices. Collaborative efforts can also address data quality, interoperability, and skill development challenges, ensuring that GST analyzers realize their full potential in transforming the lending landscape in India.

Conclusion

In conclusion, the integration of GST analyzers into India’s lending landscape represents a monumental leap forward in credit evaluation processes. By leveraging the wealth of data provided by GST filings, these sophisticated tools empower lenders with valuable insights into the financial health and operational efficiency of businesses. As technology advances and new data sources are incorporated, GST analyzers are poised to refine their capabilities further, offering customized solutions tailored to the lender’s diverse needs.

Although many good enterprises offer GST analyzer tools, finding a reliable one suitable for your needs can be quite difficult. We at Corpository ensure the right integration with tailor-made solutions. With fully customizable options, our GST analyzer comes with quick customer support that can resolve tickets in as little as 15 minutes. Check out our products or book a demo.

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.