Sieving The Right Data -

Using Bureau Analyzers To Fast-track Credit Underwriting

Did you know that CIBIL alone has over 430 million records in its database? That’s just one of the 4 major credit bureaus in India, discounting the numerous auxiliary enterprises with more data in the same domain.

In essence, that’s a lot of data. Unfortunately, If you are a lender in the current financial sphere, solid borrower verification is not a matter of assurance, but rather survival. And this data can be a burden if you are flooded with it.

Tackling this is tricky. If all this can be collected, collated, analyzed, and assimilated cleanly and simply, it would greatly speed up the credit evaluation process. That’s exactly what a Bureau Analyzer does. Let’s have an in-depth look at how this works and what are its benefits.

More Info Need Not Always Be Good Info

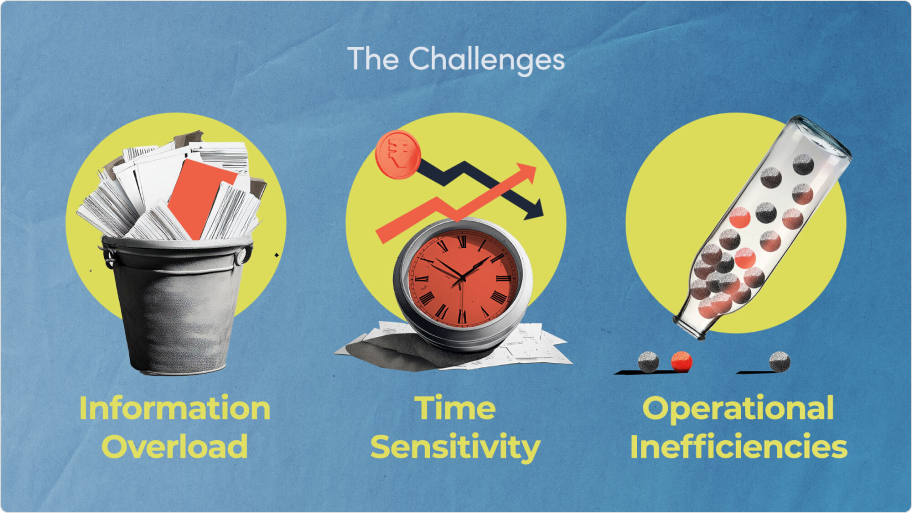

Credit underwriting poses a multifaceted challenge—how to swiftly and accurately assess creditworthiness amidst a deluge of data. Traditional methods often falter under the weight of this data, resulting in delayed decisions and compromised accuracy. The inability to promptly evaluate risk factors hampers business growth and stability, creating a void in the seamless functioning of credit evaluation processes.

- Information Overload : The rapid digitization and interconnectedness of financial systems have inundated businesses with an overwhelming volume of data from diverse sources, making it challenging to distill crucial insights efficiently.

- Time Sensitivity : Traditional methods of credit evaluation involve manual processing, leading to prolonged decision-making cycles. This delay in assessing creditworthiness can impede business growth, especially in seizing time-bound opportunities.

- Accuracy and Risk Assessment : The sheer breadth of data and the complexity of risk factors often result in incomplete or inaccurate risk assessments. This creates blind spots that leave lender portfolio susceptible to potential defaults and financial risks.

- Operational Inefficiencies : Legacy systems and disjointed processes hinder the seamless flow of credit evaluation, causing operational bottlenecks and increased resource utilization.

Fast Track Credit Underwriting With The Bureau Analyzer

Bureau Analyzers emerge as a beacon of innovation in this landscape. This tool acts as an intelligent filter, swiftly processing extensive data sets. It assimilates information from the CIBIL Bureau reports, allowing for a comprehensive evaluation that provides an overview without clutter, enhancing credit underwriting methodologies.

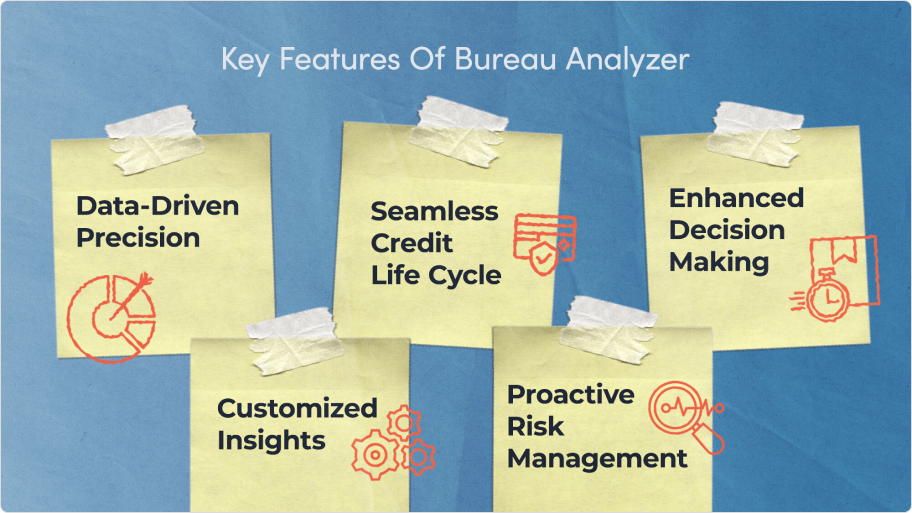

Benefits Derived:

- Data-Driven Precision : Bureau Analyzer integrates real-time data to craft a holistic view of creditworthiness. It ensures accurate risk assessment, surpassing the limitations of manual analysis.

- Enhanced Decision-Making : Speed is the essence of modern business. The tool's rapid assessment capabilities empower businesses to make informed decisions swiftly. By capitalizing on opportunities promptly, companies can optimize growth and minimize exposure to risky ventures.

- Seamless Credit Life Cycle : From sourcing to ongoing monitoring, Bureau Analyzer streamlines the credit life cycle. It enhances efficiency by minimizing operational delays, ensuring a smoother flow in credit evaluation processes.

- Proactive Risk Management : The tool's ability to proactively record factors such as delays equip businesses with strategic foresight. Armed with this knowledge, lenders can strategize effectively, mitigating potential credit pitfalls.

- Customized Insights : Bureau Analyzer doesn't offer generic solutions—it tailors insights to specific business needs. Customized data analysis allows for a deeper understanding of risks unique to each enterprise, fostering more precise decision-making.

How Does This Help Credit and Risk Teams?

The Bureau Analyzer serves as a transformative asset, revolutionizing credit evaluation processes across diverse spheres within organizations. It offers multifaceted advantages to different teams, empowering them with instant access to critical details essential for comprehensive Credit Appraisal Memo (CAM) reports. This versatile tool unleashes a spectrum of benefits:

- Summarized Key Information: Instant access to essential data.

- Effortless Analysis: Utilizes Excel's flexibility for in-depth examination.

- CAM Report Assistance: Simplifies retrieval of critical details.

For credit and risk teams, it's a game-changer, streamlining CAM report processes and granting real-time insights crucial for risk assessment. Sales teams leverage their capabilities to efficiently segment borrowers, enhancing customer engagement. Simultaneously, policy teams find it indispensable as a guiding compass, providing strategic insights for informed product development strategies. The tool ensures swift identification of delays, effectively mitigating risks and enabling proactive decision-making.

Embrace Clarity with Corpository

The Bureau Analyzer stands as a transformative force revolutionizing credit evaluation. This tool doesn't just streamline processes; it empowers multiple teams within organizations to a whole new level.

At Corpository we have ensured to upgrade the tool. With our array of numerous other products and resources that enhance credit underwriting, we are able to sharpen Corpostiory’s Bureau Analyzer as well. Have a look at how you can adopt a far more swift, seamless, and safer process at www.corpository.com..

Solutions

Platforms

Other Links

© Corpository – A Yubi Company

(Formerly CredAvenue Private Limited). All Rights Reserved.